What Does Transaction Advisory Services Do?

Table of ContentsThe 6-Second Trick For Transaction Advisory Services4 Simple Techniques For Transaction Advisory ServicesThe Ultimate Guide To Transaction Advisory ServicesThe smart Trick of Transaction Advisory Services That Nobody is DiscussingHow Transaction Advisory Services can Save You Time, Stress, and Money.

This step makes certain the service looks its best to possible purchasers. Obtaining the organization's worth right is essential for a successful sale.Purchase experts action in to aid by getting all the needed information arranged, addressing concerns from purchasers, and arranging check outs to the service's area. This builds trust with buyers and maintains the sale moving along. Getting the very best terms is vital. Purchase experts use their knowledge to assist service owners manage hard settlements, fulfill purchaser expectations, and structure deals that match the proprietor's goals.

Fulfilling lawful rules is vital in any company sale. They assist service owners in intending for their next actions, whether it's retired life, starting a brand-new venture, or managing their newfound riches.

Deal consultants bring a wide range of experience and knowledge, making sure that every aspect of the sale is taken care of skillfully. Via critical prep work, appraisal, and arrangement, TAS helps service proprietors attain the greatest possible sale price. By making sure lawful and regulative conformity and handling due persistance together with various other bargain staff member, transaction consultants lessen possible dangers and obligations.

Getting My Transaction Advisory Services To Work

By comparison, Big 4 TS teams: Work with (e.g., when a prospective buyer is carrying out due persistance, or when a deal is shutting and the buyer requires to incorporate the company and re-value the vendor's Annual report). Are with fees that are not connected to the bargain closing effectively. Gain costs per engagement someplace in the, which is less than what financial investment financial institutions earn even on "tiny deals" (but the collection likelihood is also much greater).

The interview inquiries are really similar to investment banking interview questions, yet they'll concentrate much more on bookkeeping and appraisal and much less on topics like LBO modeling. Expect inquiries regarding what the Adjustment in Working Funding means, EBIT vs. EBITDA vs. Take-home pay, and "accounting professional only" subjects like trial equilibriums and how to walk with events using debits and credit scores as opposed to monetary declaration adjustments.

10 Easy Facts About Transaction Advisory Services Shown

Professionals in the TS/ FDD teams may also speak with management about everything over, and they'll compose an in-depth report with their findings at the end of the process.

The pecking order in Transaction Providers varies a bit from the ones in investment financial and personal equity occupations, and the basic shape looks like this: The entry-level duty, where you do a great deal of data and financial evaluation (2 years for a promotion from below). The following level up; comparable work, but you get the more fascinating bits (3 years for a promotion).

In specific, it's challenging to obtain promoted beyond the Supervisor level due to the fact that few individuals leave the work at that stage, and you need to begin showing proof of your capability to generate profits to breakthrough. Allow's begin with the hours and lifestyle considering that those are easier to explain:. There are periodic late nights and weekend job, yet absolutely nothing like the frenzied nature of financial investment banking.

There are cost-of-living adjustments, so expect lower compensation if you're in a more affordable area outside significant monetary centers. For all positions except Partner, the base find out here pay comprises the mass of the overall payment; the year-end bonus could be a max of 30% of your base wage. Usually, the best way to increase your revenues is to switch over to a various company and bargain for a greater salary and perk

5 Easy Facts About Transaction Advisory Services Shown

You can enter corporate advancement, yet investment financial obtains much more hard at this stage since you'll be over-qualified for Expert functions. Company money is still an option. At this stage, you need to just stay and make a run for a Partner-level duty. If you wish to leave, perhaps relocate to a client and perform check over here their valuations and due persistance in-house.

The major trouble is that since: You typically require to sign up with another Big 4 group, such as audit, and work there for a few years and after that relocate into TS, work there for a couple of years and then move into IB. And there's still no guarantee of winning this IB function since it relies on your area, customers, and the employing market at the time.

Longer-term, there is likewise some danger of and because examining a business's historical financial information is not precisely rocket science. Yes, humans will certainly constantly require to be included, but with more advanced technology, lower headcounts could potentially sustain client involvements. That stated, the Transaction Services team defeats audit in terms of pay, work, and departure chances.

If you liked this article, you could be curious about analysis.

Excitement About Transaction Advisory Services

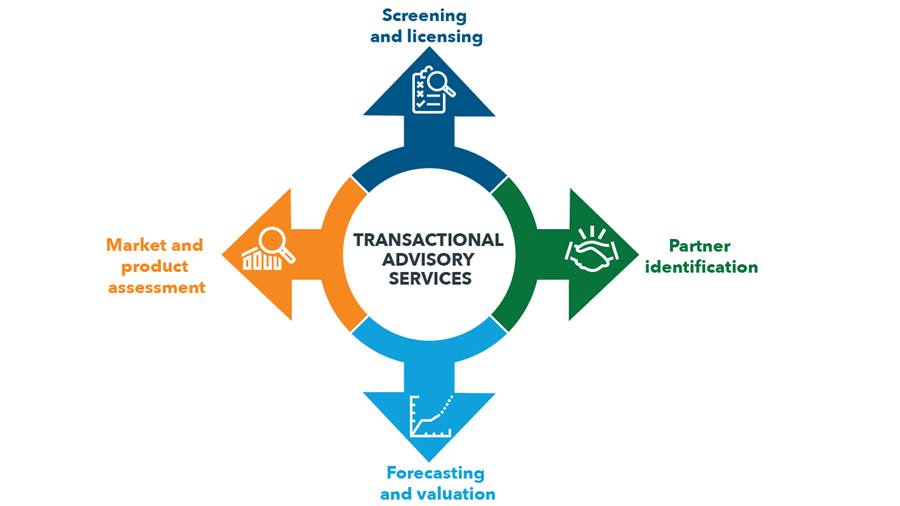

Create innovative financial structures that help in establishing the actual market worth of a firm. Offer consultatory operate in relationship to company evaluation to aid in negotiating and rates frameworks. Discuss one of the most appropriate kind of the bargain and the sort of factor to consider to use (cash money, supply, make out, and others).

Create activity strategies for risk and exposure that have been recognized. Perform integration planning to determine the process, system, and organizational modifications that may be required after the deal. Make mathematical estimates of integration prices and advantages to examine the financial rationale of assimilation. Establish standards for incorporating divisions, technologies, and business procedures.

Examine the prospective customer base, market verticals, and sales cycle. The operational due diligence offers vital understandings right into the functioning of the company to be obtained concerning risk assessment and worth creation.